-The state of Maryland requires collection and payment of 6% sales tax on all art sales. So when SMAL conducts a show and sale, it would be required to collect the sales tax from buyers and report them on a business sales and use tax filing.

However, as a non-profit 501-c(3) corporation, we are limited in our ability to act as a merchant or art gallery conducting regular retail sales. So, although we collect the sales tax from buyers, we pass on the collected tax along with the price of the art, less a commission, to the artist. In essence, the artist is actually doing the retail sale, not the Art League, which is essentially acting as a cashier for the artist.

It is up to the artist then to report the art sale and pay the sales tax to the state. To maintain our pass-through status, we are to have a record of the sales tax number for the artists in the show, much like a firm doing wholesale has to have a sales tax number of the retailers who purchase from him.

Hence, we request a sales tax number when artists register for a show.

Whenever you sell your work, sales tax should be collected and reported on the required forms (Unless you are selling it out of state). This would apply to any sales that you might have privately, through a library exhibit or other SMAL sponsored event in which you are dealing directly with the buyer.

How to get a Maryland Sales Tax Number.

These are obtained on line at the marylandtaxes.gov web site. You can also come up with a paper form to mail in. The web site is a dense forest of options and will test your determination to obtain a tax number. This multi-step process has succeeded in the past (you can see how we got there) or skip right to #6 – click here https://interactive.marylandtaxes.gov/webapps/comptrollercra/RegistrationType.asp and proceed.

- Go to marylandtaxes.gov on your browser

- Click Online Services in the top menu bar

- Click Business Taxpayer Online Services on the next screen

- Click Business Registration on the next screen

- Scroll to the bottom of the next screen and click Begin Registration

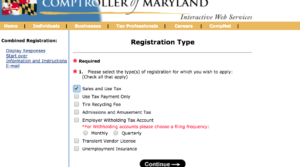

- This at last brings up Registration Type. Click Sales & Use Tax, and Continue

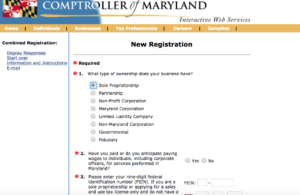

- On the next page, click Sole Proprietor, unless you have formed a legal corporation for your artwork.

- Fill in the rest of the form with the requested personal information.